Edmonton, June 18, 2019 – Camino Minerals Corp. (TSXV: COR) (OTCQB: CAMZF) (WKN: A116E1) (“Camino” or the “Company”) is pleased to provide an exploration update for the 22,000-hectare Chapitos copper-gold project, near Chala, Southern Peru.

CEO John Williamson commented, “Excellent ongoing work by our geological team is unlocking the value of the Chapitos project and we look forward to the 2019 drilling program with much anticipation”.

Soil and Rock Sampling Summary

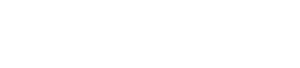

An extensive soil sampling program covering the entire Chapitos property has recently been completed with 400 m line spacing and 25 m sample intervals, including select areas with tighter 200 m line spacing. The entire data set consists of over 17,000 soil samples across the 22,000-ha property. The majority of these samples were initially analyzed for Cu-only using a portable XRF analyzer with the remainder of the samples submitted for multi-element ICP analysis. Contoured copper-in-soil data is illustrated on Figure 1. The data highlighted the known zones of copper mineralization on the Diva and Atajo Trends, although interestingly the strongest anomalies are spatially associated with monzonite intrusive bodies and the newly discovered Lidia Zone. Collectively over 40-line kilometres of soil anomalies have yet to be explored.

Subsequent work on the various zones of mineralization resulted in the recognition of the project’s potential to host a number of geochemically diverse styles of mineralization (i.e. Cu Manto, Cu Porphyry-IOCG, structurally hosted and/or disseminated Au, etc.). As such Camino is in the process of reanalyzing the archived soil samples to collect the full spectra XRF data to determine pathfinder element relationships associated with various styles of mineralization, providing priority targets for trenching, ground geophysics, mapping, prospecting, and expanded soil sampling programs.

Follow-up prospecting of the copper-in-soil anomalies has extended the mineralization along strike at both the Diva and Atajo Trends, with rock samples although selective in nature up to 6.91 % copper and 6.03 % copper, respectively (Figure 1). The Diva Trend can now be traced along strike for >7 km and the Atajo Trend for >12 km, both of which remain open. Detailed geological mapping and prospecting is ongoing in this area to delineate possible drill targets for the 2019 program. Previously unrecognized mineralization at what is now known as the Lidia Zone (see March 28 press release) was identified from a large 3 km by 4 km copper-in-soil anomaly, approximately 5 km northwest of the Adriana Zone. A total of 238 rock samples have been collected in the Lidia area that, although somewhat selective in nature, collectively average 0.20 g/t gold and 0.75% copper with individual samples returning values of up to 11.1g/t gold and 23.4% copper (Figure 1). Mineralization is hosted within stockwork quartz veins, some of which are associated with zones of shearing and brecciation within the host Monzonite. This style of mineralization differs from that observed on the Diva Trend and further work is ongoing to characterize the Lidia copper-gold zone.

Figure 1: Chapitos exploration zones and rock sample data overlain on contoured copper-in-soil data.

Drilling Results Summary

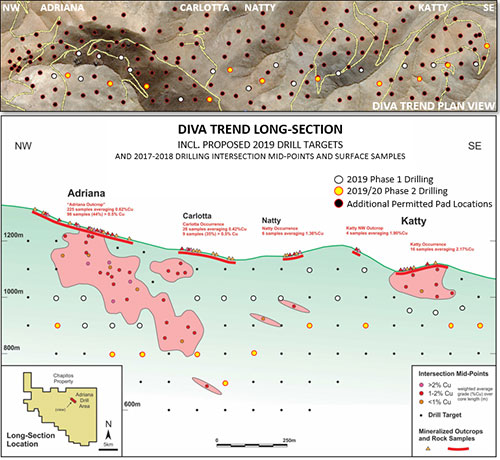

To date on the Chapitos project the drilling has focused primarily on the Diva Trend mineralization with the exception of several exploratory holes on the Atajo Trend. The drilling on both Trends has been spatially restrictive because of permitting limitations. This has recently been remedied with the approval of Camino’s 200 drill-pad permit allowing for 908 holes or 445,000m of drilling over the next 3.6 years (see June 7 press release). Drilling on the Diva Trend has focused on mineralization and associated alteration envelope that is spatially related to the northwest-southeast oriented steeply-dipping Diva structure. The mineralization can in general be subdivided into an upper copper-oxide bulk-tonnage zone with broad intercepts and a deeper high-grade copper-sulphide rich zone, a summary of select drill holes is highlighted below in Table 1. At deeper levels in the system and with proximity to the Diva fault the mineralization is associated with a structurally controlled breccia zone which has been cemented with copper sulphides. This mineralization may have been remobilized at higher levels and is in places stratigraphically controlled oxide copper and chalcocite mineralization. The mineralization on the Diva Trend remains open along strike and at depth.

Table 1: Selected Drill Results

| Hole ID | Zone | Dip | Azimuth | From (m) | To (m) | Interval (m)* | Copper Grade (%) |

|---|---|---|---|---|---|---|---|

| CHR-002 | Adriana | -50 | 135 | 188 | 294 | 106 | 1.3 |

| Incl. | 230 | 268 | 38 | 2.12 | |||

| DCH-001 | Adriana | -62 | 135 | 190 | 358.5 | 168.5 | 0.72 |

| Incl. | 330 | 357 | 27 | 1.63 | |||

| DCH-012 | Adriana | -56 | 229 | 175 | 271.5 | 96.5 | 0.93 |

| Incl. | 197.5 | 217 | 19.5 | 2.03 | |||

| Incl. | 24.5 | 250 | 4.5 | 5.01 | |||

| DCH-019 | Adriana | -45 | 229 | 201.5 | 243.5 | 42 | 0.97 |

| Incl. | 222.5 | 230 | 7.5 | 3.31 | |||

| DCH-025 | Adriana | -45 | 225 | 158.9 | 175.2 | 16.3 | 1.43 |

| Incl. | 168.5 | 175.2 | 6.7 | 2.62 | |||

| DCH-049 | Adriana | -55 | 195 | 106.1 | 155.5 | 49.4 | 0.82 |

| Incl. | 137.5 | 146.5 | 9 | 2.04 | |||

| DCH-024 | Adriana | -63 | 205 | 226 | 308.5 | 82.5 | 1.31 |

| Incl. | 263.5 | 295.2 | 31.7 | 2.19 | |||

| DCH-034 | Adriana | -60 | 190 | 63.5 | 158.5 | 95 | 0.85 |

| Incl. | 125.6 | 131.8 | 6.2 | 2.81 | |||

| Incl. | 152.3 | 158.5 | 6.2 | 3.16 | |||

| DCH-033 | Adriana | -62.5 | 218 | 316 | 386.3 | 70.3 | 1.14 |

| Incl. | 335.7 | 347.7 | 12 | 3.16 | |||

| DCH-046 | Atajo | -45 | 225 | 48.4 | 64.7 | 16.3 | 0.83 |

| Incl. | 51.2 | 56.2 | 5 | 2.09 | |||

| DCH-041 | Atajo | -45 | 270 | 28.5 | 46.3 | 17.8 | 0.75 |

| Incl. | 40.3 | 43.3 | 3 | 2.15 | |||

| DCH-017 | Katty | -50 | 28 | 73.3 | 91.8 | 18.5 | 1.3 |

| Incl. | 83 | 91.8 | 8.8 | 2.2 |

*True thickness to be determined.

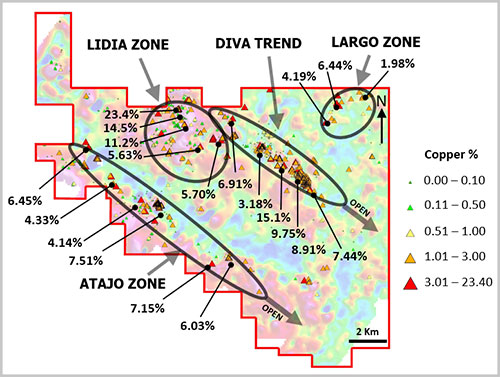

The Diva Trend has alteration and mineralization consistent with both IOCG and Chilean ‘Manto style’ mineralizing system, as illustrated on Figure 3. Only 100 km northwest of the Chapitos property is the Mina Justa IOCG deposit that has reserves of 346.6 Mt at 0.71% Cu. Using Mina Justa as an analogue for Chapitos in conjunction with the schematic deposit model below provides an effective exploration tool to evaluate other areas of the property.

Figure 2: Schematic deposit model

2019 Drilling Program

The 2019 drilling program has been designed after compilation of the company’s previous drilling, extensive geophysical and geochemical datasets, and bedrock mapping results on the property. The flexibility in drilling location provided by the new 200 drill-pad permit allows Camino to optimize drill collar locations along the Diva Trend. This, in conjunction with a planned geophysics program, will help further define and potentially expand on the copper mineralized zones at Adriana, Katty, and along strike to Vicky, but also include drilling designed to evaluate the potential for additional zones of copper mineralization along the Diva Trend. The drilling will be completed in two phases. Phase one has been designed to expand areas of known mineralization and test the continuity of the mineralizing system between zones, allowing for the potential expansion of the mineralized footprint (Figure 2). Phase two will trace the mineralization to depth and include exploratory drilling of new targets along the Diva Trend. This drilling program will enable the Company to further its understanding of the geology and mineralization as it works towards gathering information for a future resource estimation effort.

Figure 3: 2019/20 proposed drilling plan on the Diva Trend

Other

All samples were submitted for preparation and analysis by ALS Chemex at its facilities in Lima, Peru. All samples were analyzed using multi-digestion with ICP finish and select samples were analyzed for gold using fire assay with AA finish. Samples over 1% copper were reanalyzed using four acid digestion with an ore grade ICP finish. Mineralized samples were analyzed for acid soluble copper by being agitated at room temperature in a 5% sulphuric acid solution with the copper content measured by AA. One in 20 samples was blank, one in 20 was a standard sample, and one in 20 samples had a sample cut from assay rejects assayed as a field duplicate at ALS Chemex in Lima, Peru.

Grant of Stock Options

The Company has granted incentive stock options to various directors, officers and consultants to purchase up to 2,500,000 common shares of the Company on or before June 17, 2024, at an exercise price of $0.15 per share.

About Camino Minerals Corporation

Camino is a discovery-oriented mineral exploration company. The Company is focused on the acquisition and development of high-grade copper and precious metal projects. For more information, please refer to Camino’s website at www.caminominerals.com.

| ON BEHALF OF THE BOARD | For Further information, please contact: |

| /S/ “John Williamson” | Jeremy Yaseniuk, Director |

| Resident and CEO | jeremyy@metalsgroup.com |

| Tel: (604) 773-1467 |

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release may contain certain “forward looking statements”. Forward-looking statements involve known and unknown risks, uncertainties, assumptions and other factors that may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Any forward-looking statement speaks only as of the date of this news release and, except as may be required by applicable securities laws, the Company disclaims any intent or obligation to update any forward-looking statement, whether as a result of new information, future events or results or otherwise.